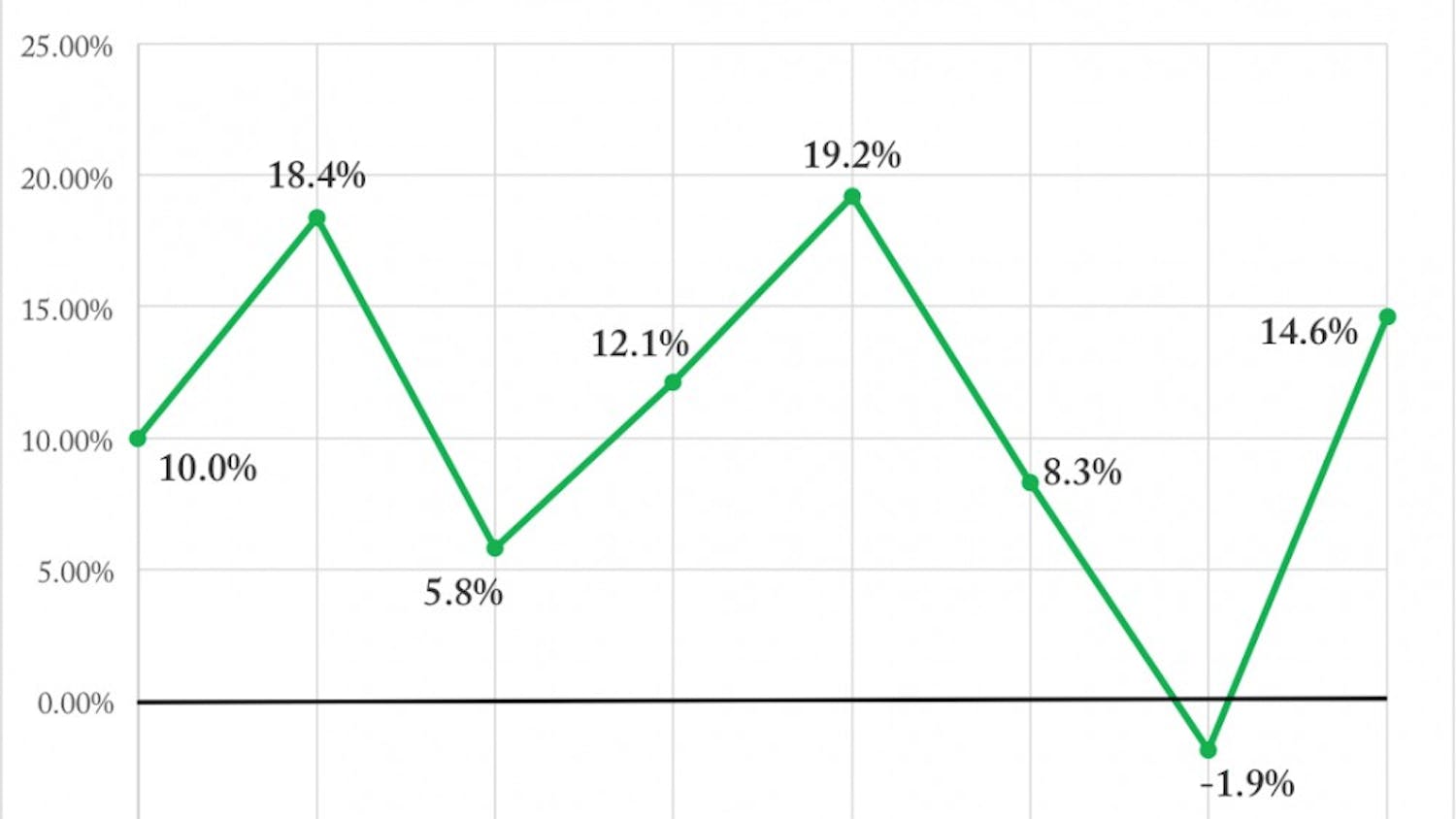

On Sept. 17, the College announced that its endowment grew by 7.5 percent over the past year, reaching a total value of $5.7 billion. Growth has been even greater in past years — the endowment grew an average 10.7 percent annually over the past decade, well past the rate of inflation. Yet rather than use this wealth to dramatically reduce tuition, the College seems content to sit back and count its billions.

For the 2019-20 school year, undergraduate expenses will total roughly $76,000, including all costs like tuition, housing and dining plans. The expense is nothing short of absurd. For too long, top colleges like Dartmouth have gotten away with charging exorbitant tuitions, all while hoarding rapidly growing endowments. It is time for schools to totally reset how they manage their expenses, taking advantage of their substantial wealth rather than ringing tens of thousands of dollars annually from hard-pressed families.

Ivy League schools and other elite colleges benefit from a de facto monopoly in an increasingly status-obsessed world. Students believe they must attend a prestigious college in order to succeed, and that failing to do so means “throwing your future away.” To be sure, these assumptions also deserve re-examination. But, as it stands, young people feel massive pressure to attend a highly-ranked school, no matter the cost. With the exception of a few elite state schools, top colleges get away with charging in excess of $70,000 for the privilege of attendance.

Of course, a sizeable number of students do not pay full price due to financial aid, but elite colleges could continue offering generous aid while cutting their sticker price dramatically. In 2017, for instance, Dartmouth’s endowment profited $630 million from investment income, not including new donations. The fund distributed $225 million to the College’s operating budget and accounts for 25 percent of total net operating revenue. Tuition, meanwhile, covered roughly 23 percent of revenue, about another $200 million. Simple arithmetic shows if the College had covered all tuition and fees with the endowment, it would have come out over $200 million in the black. At Dartmouth, going tuition-free would still leave room for millions of dollars in endowment profits.

Other top institutions present similarly rosy statistics. Harvard’s endowment now stands at a whopping $39.2 billion, up from $26 billion a decade ago. Overall, the 120 largest college endowments totaled to $401 billion in 2016.

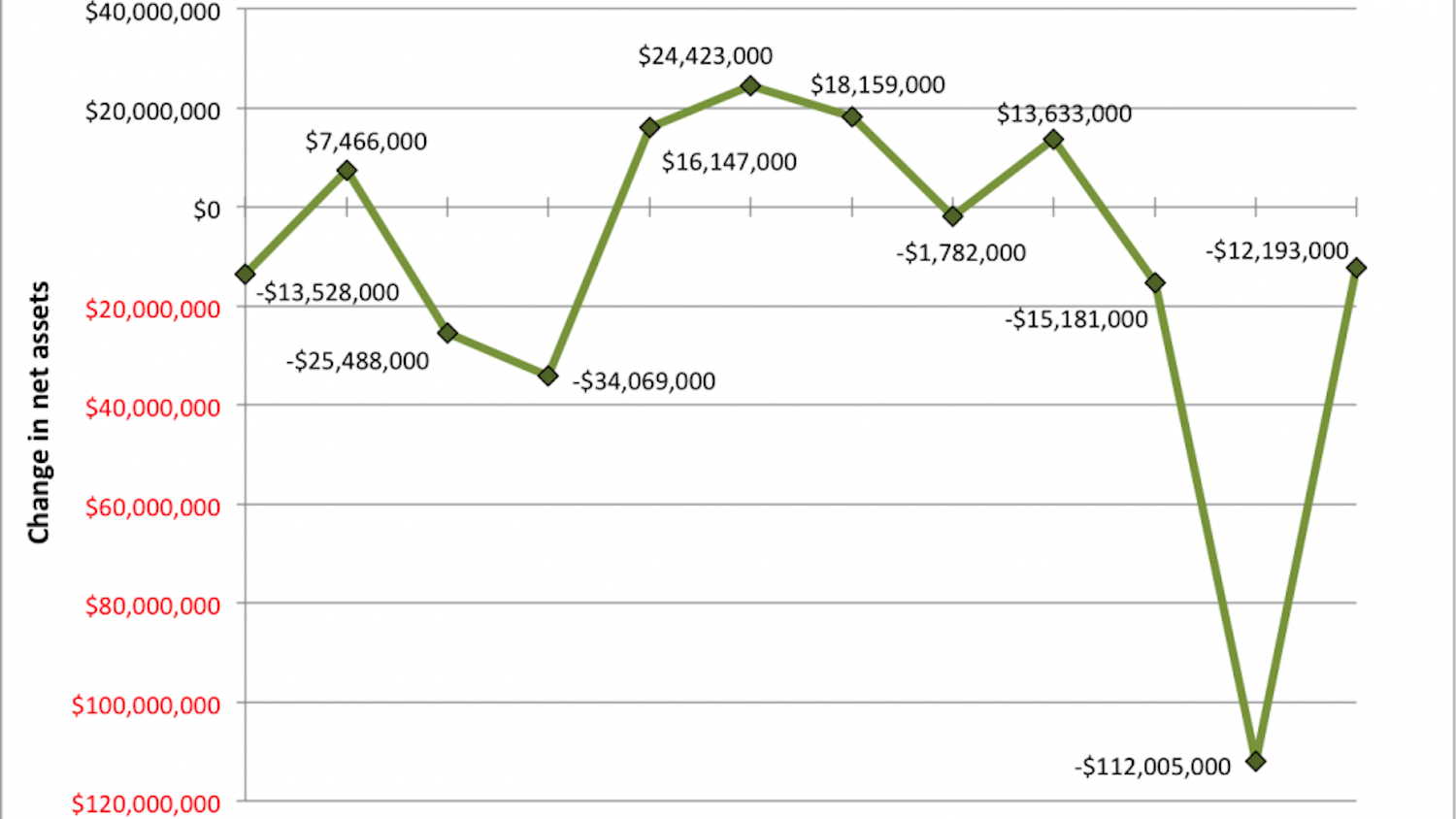

But if these schools really have such strong finances, what’s holding them back? Many administrators cite concerns over long-term growth and financial security — past recessions led to temporary losses for some colleges. Furthermore, since endowments are heavily invested in stocks and mutual funds, directly spending these investments presents logistical challenges. Sitting on large endowments simply amounts to prudence and foresight, the reasoning goes. It is difficult to say for sure if the College would finance everything it currently does if funds were redirected to tuition, but this is an issue of morality that demands a reprioritization of value.

College endowments continue to grow from investment income alone, notwithstanding additional donations, which added a further $47 billion to college endowments in 2018 alone. In such an environment, the “need for caution” rings hollow. At least one school has already recognized something must change. In 2018, New York University announced that its medical school would go tuition-free for all current and future students. Though students still have to pay for room and board, the university now covers the entire $55,000 tuition. In order to finance the program indefinitely, NYU plans to raise $600 million in seed money, $450 million of which was already raised by the time of the announcement. An ambitious capital campaign at Dartmouth could likely raise the same amount or greater, given that during the ongoing Call to Lead fundraising campaign, alumni donated over $420 million to the College in 2018 year alone.

NYU based its decision on a “moral imperative” to counter the student debt crisis, in which an estimated $1.5 trillion is owed in government student loans alone. But the wealthiest institutions in the country still ask their students to contribute an outsize share of the funding. Just as in the 1960s and ’70s, when many top colleges began to admit women, it is time for a rebirth of ambition in higher education. That change can start right here at Dartmouth. President Hanlon and the Board of Trustees sit on massive sums of money that could dramatically reduce tuition expenses. It is their moral imperative to act.