The trustees also voted to raise the amount of financial aid offered for the next fiscal year to $82 million, a 6.5 percent increase from the $77 million in aid offered in 2012-2013. The Board raised tuition at their termly meeting on Friday and Saturday to discuss College finances and student affairs.

"Cost is a huge concern to the Board, and they're certainly cognizant of it," media relations director Justin Anderson said. "I think that that's why there is such a commitment to providing funds for scholarship awards and financial aid."

While the rise in the College's undergraduate cost is the lowest percent increase in over 10 years, Dartmouth's tuition will reach $45,445, which surpasses Columbia's current tuition of $45,028. Columbia, the most expensive Ivy in 2012-2013, has yet to announce its costs for 2013-2014.

The overall cost of attending Dartmouth, including room and board and mandatory fees, also exceeds Columbia's current cost of $58,744.

"I think just to say that because Columbia is in the middle of Manhattan and Dartmouth is in Hanover, that therefore a Dartmouth education should be dramatically less expensive, is just not reflective of the reality of the situation," Anderson said.

Princeton University recently announced a 3.8 percent increase in undergraduate costs to $54,165, and Brown approved a 4 percent increase to $57,232 for the next academic year. The University of Pennsylvania, Cornell University, Yale University, Harvard University and Columbia have not yet announced tuition changes.

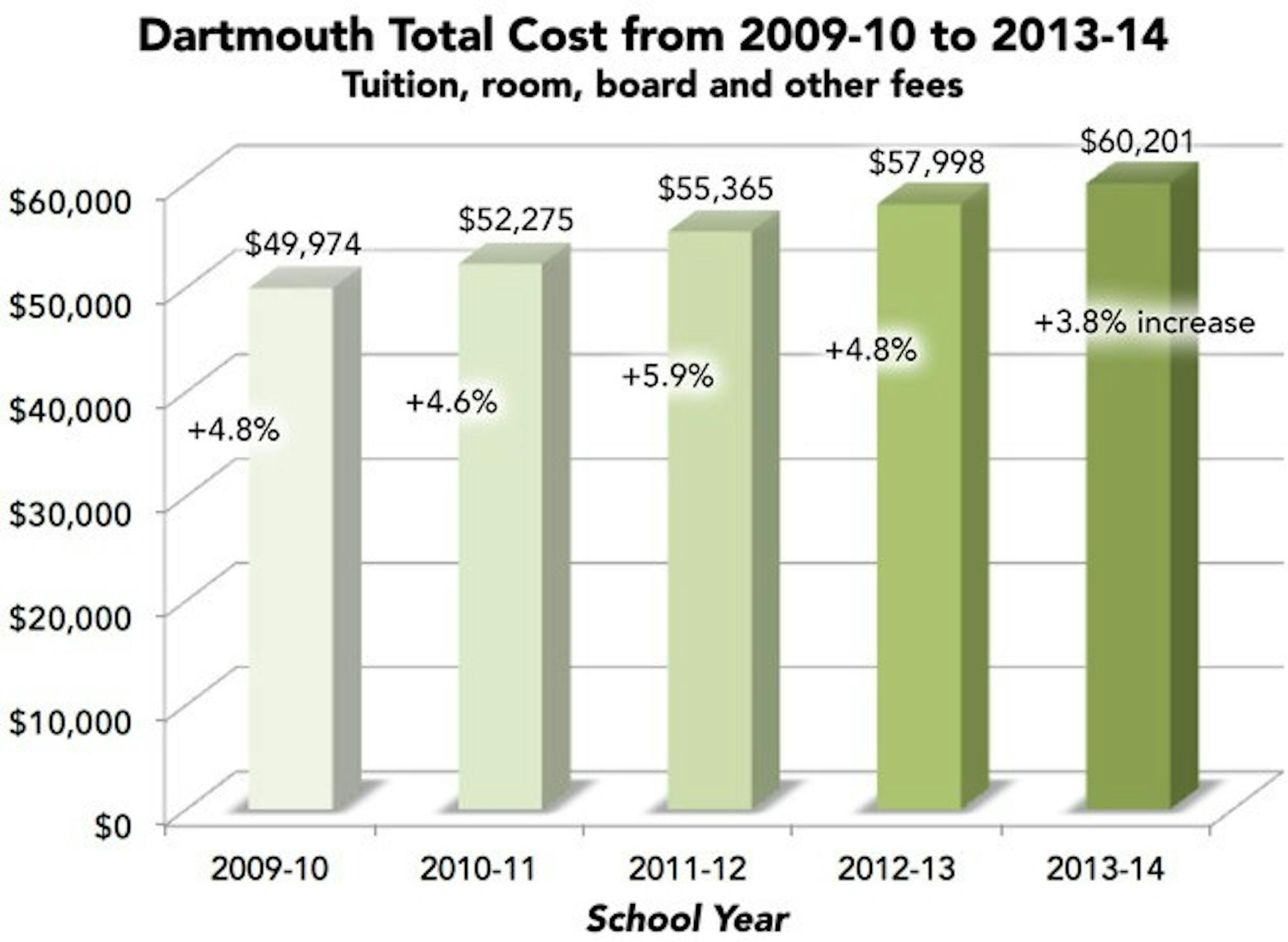

Although the College's cost increase exceeds The Wall Street Journal economic forecasting survey's inflation rate predictions of roughly 2 percent for 2013, the increase is lower than the tuition hikes at the College in the last five years, which ranged from 4.8 to 5.9 percent.

In the 2012-13 school year, the College's cost of attendance was $57,996, roughly 4.8 percent higher than that of the previous year.

Anderson said rising tuition costs do not fund increasing financial aid budgets.

"We have a lot of things that we have to fund, and financial aid is one of those things, but that doesn't mean that all financial aid comes from tuition because it most definitely does not," he said.

Dartmouth students graduate with an average of $19,000 of debt, Anderson said. According to an October 2012 report published by the Project on Student Debt, in 2011 New Hampshire students graduated with the highest levels of debt in the country with an average of $32,440.

During the weekend meeting, the trustees approved a fiscal year 2014 operating budget of $981 million, which represents a 5 percent increase from the $934 million budget for fiscal year 2013.

The increase in the operating budget is reflective of inflation, institutional growth and the need to hire and retain "excellent" faculty, Anderson said.

The rise in financial aid allocation accounts for part of the increased overall operating budget. Additionally, nationally increasing health care costs contribute to a rise in employee benefit package costs, Anderson said.

The trustees approved an estimated distribution from the endowment for fiscal year 2014 of $187 million, or 5.2 percent. The distribution, which is the percentage of the endowment used to cover operating and non-operating costs, has seen a steady percentage rate decrease since the 7.2 percent distribution of fiscal year 2010. The 2008 financial crisis impacted endowments across the country and forced many institutions to seek higher percent distribution rates to cover operation costs.

"Since that time we have been trying to get the number down in the 5 percent vicinity," Anderson said. "We still have some work to do, but we are making good progress."

Tuition for the Geisel School of Medicine will increase 5.5 percent to $53,432, while tuition for the Tuck School of Business will rise 4.9 percent to $58,935.

"Each entity has its own budget and its own expenses and revenues so it wouldn't necessarily make sense for all of them to be the same," Anderson said.

Matthew Rennie '16 expressed concern over the effects of tuition increases on incoming students given the country's financial state.

"I feel it is surprising that it's the most expensive Ivy League," Rennie said. "Increasing tuition, especially with the economy not being great right now, may not be a good thing for some people and may make Dartmouth less of a viable option right now."

Aylin Woodward '15, who receives partial financial aid and funds the rest of her education through personal and family contributions, said she was interested to know what tuition is comprises and the aspects of tuition that are experiencing cost increases. She explained that higher tuition may cause more students to seek jobs on campus and in the Hanover area.

"I am in an awkward gray area, so it means that I have to make certain financial accommodations for next year," she said.

Ethan Canty '15 said he was interested to know whether increasing tuition on students who do not receive financial aid brings net gains to the College.

"Since the financial aid is still increasing, it makes you wonder if this is the way that the College can get more money through students who don't receive financial aid and will still have to pay that increased money," he said.

Anderson said the College is committed to meeting 100 percent of students' demonstrated financial need. Currently, 45 percent of the student body receives financial aid, and the average financial aid grant for these students covers 66 percent of the cost of attendance. The average price of attending the College for members of the Class of 2016 is roughly $43,000.

Last year, the College raised the free tuition and no-loan threshold to students whose family incomes are less than $100,000 per year. These students are also granted scholarships, grants or work-study opportunities to cover the costs of mandatory fees and room and board.

Toan Do '12 said that while he doubts tuition increases will cause students to transfer out, the cost may deter students from applying or accepting offers of admission. Increased financial aid may improve incoming students' perceptions of the College.

"As long as the financial aid keeps up or compensates for the increase in tuition, I think that's fine," Do said.

The College's financial aid helps maintain low debt levels for students upon graduation, Anderson said.

"We are in an outstanding position to attract an incredibly economically diverse student body, which is always one of our goals and which we feel like we do a pretty good job of attracting," Anderson said.

The Board of Trustees meeting also included a presentation on the state of the College by Interim College President Carol Folt, as well as reviews of strategic planning by the deans of Dartmouth's professional schools, Dean of the Faculty of Arts and Sciences Michael Mastanduno and Dean of Graduate Studies Brian Pogue.